The counties of Kauaʻi and Hawaiʻi, and Hawaiʻi Community Lending (HCL) announced today their Homeowner Assistance Fund (HAF) programs will close their application portal on May 1, 2024. See press release here for more information.

HAF program funding for the programs will be fully obligated by September 30, 2024.

Homeowners who reside on Kauaʻi or Hawaiʻi and are interested in applying for the programs must submit complete applications no later than 11:59 p.m. on April 30, 2024, to be considered for funding.

Save your home

Grants up to $60,000

Available to homeowners on Hawai‘i Island or Kaua‘i.

Grants can be used for:

- Mortgage Assistance: Reinstatement, Principal Reduction – Recast, or Loan Modification

- Reverse Mortgage

- Mortgage Payment Assistance for up to 12 months

- Real Property Tax

- HOA or Condo Fee

- Homeowners Insurance Premium

- Utilities (electric, water, gas, sewer/trash)

Mortgage assistance is limited to homeowners who reside on Hawai‘i Island and Kaua‘i who have loans with participating mortgage servicers ONLY. If your mortgage servicer is not listed below, you are ineligible to receive funds at this time.

See participating mortgage servicers.

Learn how your mortgage servicer can participate here.

Document checklist

- 30 days most recent income documents for ALL income sources

- Most recent profit-loss statement (if self-employed)

- 30 days of most recent bank account statements, credit card statements, and utility bills for ALL accounts

- Public benefits statements (i.e. SSI/SSDI, SNAP, TANF, General Assistance)

- 2019 Federal Tax return

- Most recent Federal Tax return

- Copy of mortgage statement

- Copy of past due property tax or HOA fee bill, notice of default, or notice of sale (if facing foreclosure)

- Birth Certificate (if Native Hawaiian)

How to apply

Online:

By phone:

Call 808.587.7656

In‐person at the Hawai‘i Island or Kaua‘i Financial Opportunity Center (appointment required)

• 1315 Kalanianaole Avenue, Hilo, HI 96720

• 3116 Akahi Street, Lihue, HI 96766

Returning applicant? Follow the link to log into your portal:

For more information, review our Frequently Asked Questions

Download Flyer:

Hawai‘i Island Flyer

Kaua‘i Flyer

HAF:

• Live in your home on Hawai‘i Island or Kaua‘i.

• Own no other real property.

• Have experienced financial hardship (i.e. a 10% decrease in annual income or 10%

increase in household expenses since March 2020).

• Have less than five times your monthly mortgage payments (does not include pension/401k).

• Have a mortgage with one of the qualifying mortgage servicers listed below, reverse mortgages allowed (not required for past-due property taxes and past-due HOA fees).

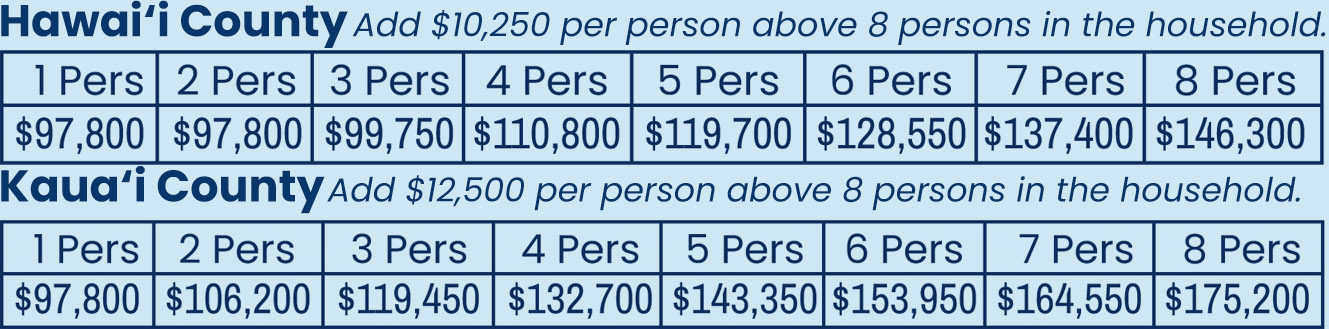

• Meet the maximum annual household income requirements:

Funding is limited to homeowners who reside on Hawai‘i Island and Kaua‘i who have loans with participating mortgage servicers ONLY. If your mortgage servicer is not listed below, you are ineligible to receive funds at this time.

Participating mortgage servicers list:

• American Savings Bank

• Arvest Central Mortgage Company

• Bank of Hawai‘i

• Big Island FCU

• BSI Financial Services

• Caliber Home Loans

• Capital Mortgage Servicers of Texas

• Carrington Mortgage

• CENLAR

• Central Pacific Bank

• Chase

• Click n’ Close

• Colonial Gold

• Community Loan Servicing

• County of Hawai‘i

• County of Kaua‘i

• CUSO

• Dovenmuehle

• Fay Servicing

• First Hawaiian Bank

• Flagstar

• Freedom Mortgage

• Gather Federal Credit Union

• Gregory Funding

• Guild Mortgage Company

• Habitat for Humanity Hawai‘i Island

• HFS Federal Credit Union

• HomeStreet Bank

• Interfirst Mortgage Company

• Kaua‘i Federal Credit Union

• Kaua‘i Habitat for Humanity

• Lakeview Loan Servicing

• Loan Care

• Loan Depot

• M&T Bank

• Mr. Cooper/Right Path Servicing

• Nations Lending Corp

• Navy FCU

• New American Funding

• Payment Servicing Corp

• PennyMac

• PHH Mortgage Corporation

• PNC Bank

• Planet Home Lending

• Rocket Mortgage

• Roundpoint

• Rushmore

• Select Portfolio Servicing (SPS)

• Selene Finance LLP

• Servbank

• ServiceMac

• Shellpoint

• SLS

• SN Servicing Corp

• The Money Source

• Truist

• US Bank

• USDA Rural Development

• Valon Mortgage

• Wells Fargo

If your mortgage servicer is not participating in the program, consider downloading and sending this Participating Servicer Request Letter to your mortgage servicer to ask them to help you become eligible for Homeowner Assistance Fund grants

Find out how your company can become a servicer. View our Servicer Welcome Packet and our Mortgage Servicer Information video for more information.

The Homeowner Assistance Fund provides grants up to $30,000 to help homeowners who have experienced financial hardship pay past-due mortgages, past-due property taxes and past-due HOA fees.

All applicants will be referred to free housing counseling to assist homeowners create action plans to sustain homeownership.

No, you do not have to be past due on your mortgage to be eligible for the program. Once you complete an application, you will receive a Homeowner Questionnaire that will guide you on the best next step to resolve your mortgage issues.

To apply – call 808.587.7656, email HAF [at] hawaiianCommunity.net or visit the Hawai‘i Island or Kaua‘I Financial Opportunity Center. See above the required documents due at application.

Once you submit your Homeowner Assistance Fund application, you will be asked to complete a pre- screening Homeowner Questionnaire.

The Questionnaire will inform you if you qualify for the Homeowner Assistance Fund. It will also tell you the best next step and resources to address your situation.