Homeowner Assistance Program

Eligible assistance types

HCL can help with:

– Past-due mortgage payments (arrears)

– Past-due utilities and home energy costs

– Past-due property taxes

– Homeowner, hurricane, and/or flood insurance

– Homeowners association (HOA) or common area maintenance fees

– Mortgage Principal Reduction (if applicable)

Eligibility requirements

Applicants must:

– reside on Hawaiian Home Lands in a dwelling unit.

– demonstrate financial hardship (e.g., loss of employment, increased household expenses).

– provide documentation of housing instability (e.g., late notices, shut-off warnings, delinquent mortgage statements).

– have household income equal to or less than 80% of the Area Median Income (AMI) as determined by HUD.

– complete one (1) HUD counseling session with a DHHL-approved HUD counseling agency.

– not duplication of federal benefits

Income limits by county

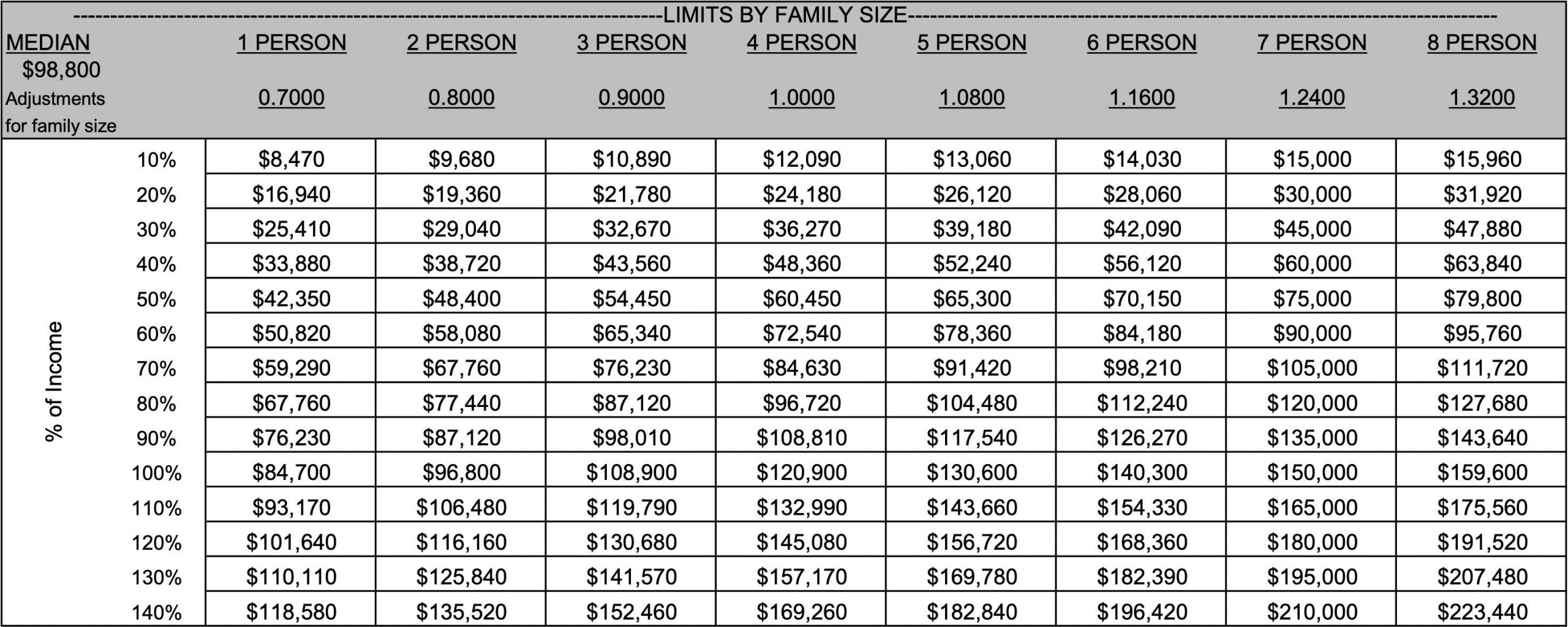

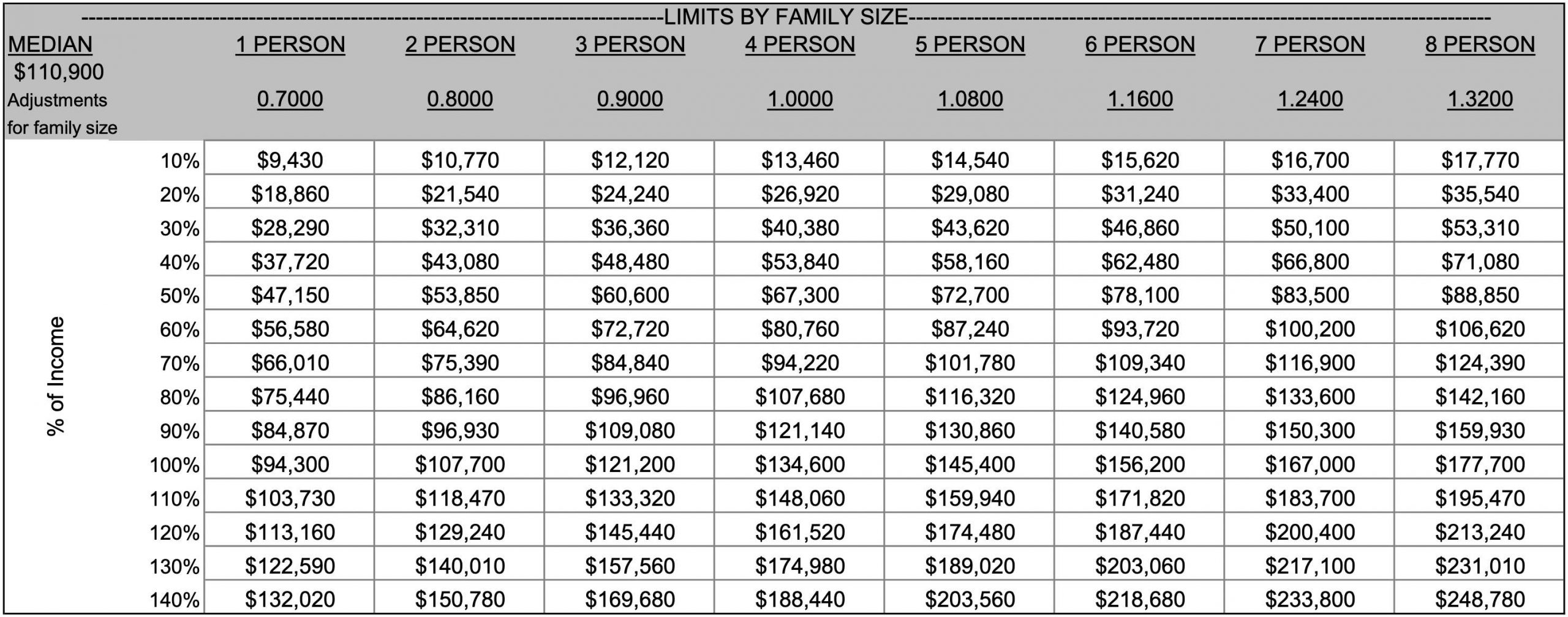

Hawai‘i County Income Schedule by Family Size

The following table presents income limits by family size and by percentages of the very low income levels established by HUD. These income limits serve as guidelines to establish sales/rental preferences.

The U.S. Department of Housing and Urban Development (HUD) sets income limits that determine the eligibility of applicants for its assisted housing programs. HUD typically uses the Very Low-Income Limit (VLIL) as the basis for deriving other income limits. The VLIL is calculated by taking the 4-person income limit equal to 50% of the estimated median family income (based on the U.S. Census Bureau’s ACS median family income estimates) and making adjustments if this income is outside formula constraints. For example, the VLIL is increased for areas where rental housing costs are unusually high in relation to the median income or if it is less that the relevant State non-metropolitan median family income level. See https://www.huduser.gov/portal/datasets/il.html#faq_2025

These income limits are not used for projects funded with tax credits under section 42 of the Internal Revenue Code and projects financed with tax exempt housing bonds issued to provide qualified residential rental development under section 142 of the Internal Revenue Code, i.e., LITHC, RHRF, etc. Go to HHFDC’s website at https://dbedt.hawaii.gov/hhfdc/files/2025/04/2025-MTSP-Income-Limits-2025-04-01.pdf for tax credit rental program projects.

NOTE: This chart is provided as a guide only.

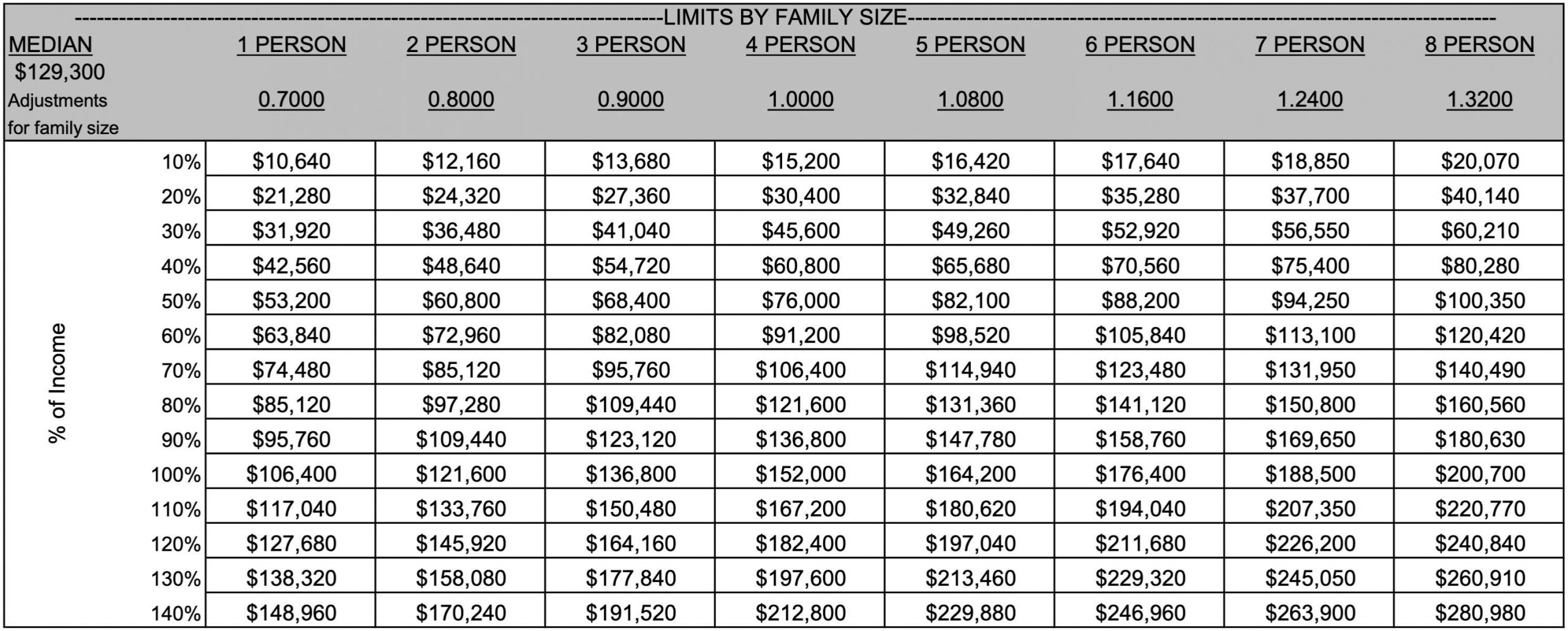

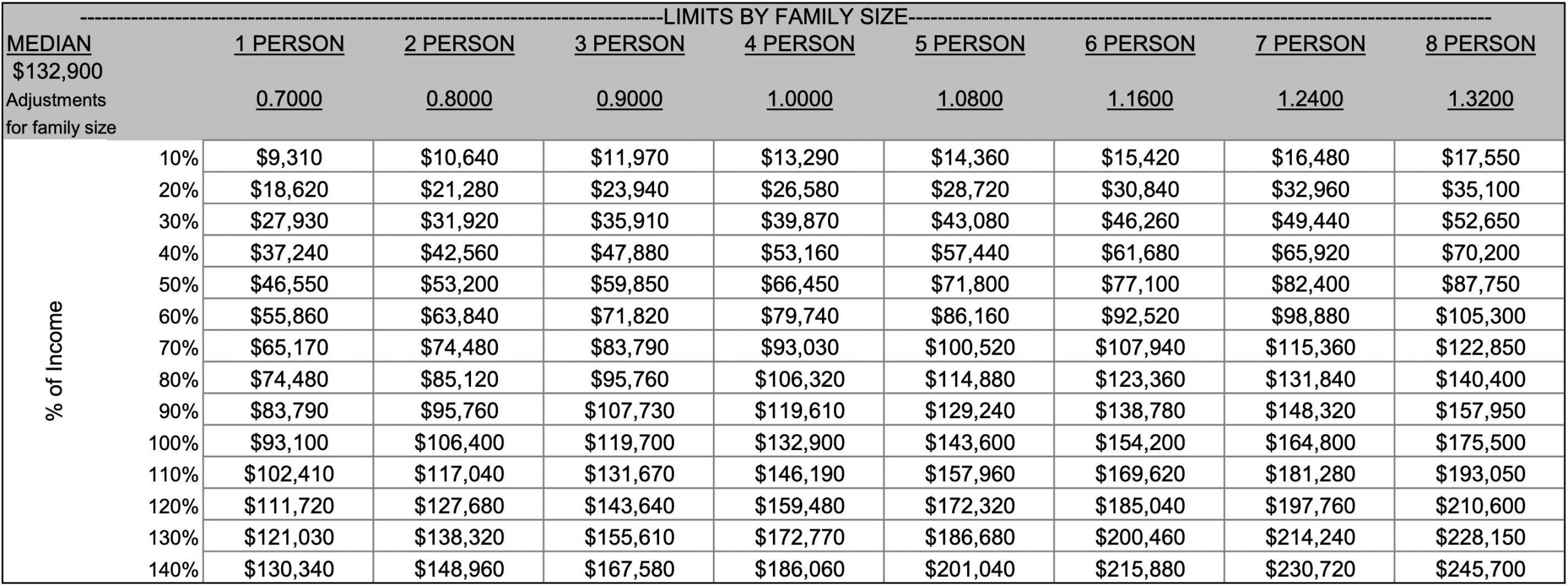

Honolulu County Income Schedule by Family Size

The following table presents income limits by family size and by percentages of the very low income levels established by HUD. These income limits serve as guidelines to establish sales/rental preferences.

The U.S. Department of Housing and Urban Development (HUD) sets income limits that determine the eligibility of applicants for its assisted housing programs. HUD typically uses the Very Low-Income Limit (VLIL) as the basis for deriving other income limits. The VLIL is calculated by taking the 4-person income limit equal to 50% of the estimated median family income (based on the U.S. Census Bureau’s ACS median family income estimates) and making adjustments if this income is outside formula constraints. For example, the VLIL is increased for areas where rental housing costs are unusually high in relation to the median income or if it is less that the relevant State non-metropolitan median family income level. See https://www.huduser.gov/portal/datasets/il.html#faq_2025

These income limits are not used for projects funded with tax credits under section 42 of the Internal Revenue Code and projects financed with tax exempt housing bonds issued to provide qualified residential rental development under section 142 of the Internal Revenue Code, i.e., LITHC, RHRF, etc. Go to HHFDC’s website at https://dbedt.hawaii.gov/hhfdc/files/2025/04/2025-MTSP-Income-Limits-2025-04-01.pdf for tax credit rental program projects.

NOTE: This chart is provided as a guide only.

Kaua‘i County Income Schedule by Family Size

The following table presents income limits by family size and by percentages of the very low income levels established by HUD. These income limits serve as guidelines to establish sales/rental preferences.

The U.S. Department of Housing and Urban Development (HUD) sets income limits that determine the eligibility of applicants for its assisted housing programs. HUD typically uses the Very Low-Income Limit (VLIL) as the basis for deriving other income limits. The VLIL is calculated by taking the 4-person income limit equal to 50% of the estimated median family income (based on the U.S. Census Bureau’s ACS median family income estimates) and making adjustments if this income is outside formula constraints. For example, the VLIL is increased for areas where rental housing costs are unusually high in relation to the median income or if it is less that the relevant State non-metropolitan median family income level. See https://www.huduser.gov/portal/datasets/il.html#faq_2025

These income limits are not used for projects funded with tax credits under section 42 of the Internal Revenue Code and projects financed with tax exempt housing bonds issued to provide qualified residential rental development under section 142 of the Internal Revenue Code, i.e., LITHC, RHRF, etc. Go to HHFDC’s website at https://dbedt.hawaii.gov/hhfdc/files/2025/04/2025-MTSP-Income-Limits-2025-04-01.pdf for tax credit rental program projects.

NOTE: This chart is provided as a guide only.

Maui County Income Schedule by Family Size

The following table presents income limits by family size and by percentages of the very low income levels established by HUD. These income limits serve as guidelines to establish sales/rental preferences.

The U.S. Department of Housing and Urban Development (HUD) sets income limits that determine the eligibility of applicants for its assisted housing programs. HUD typically uses the Very Low-Income Limit (VLIL) as the basis for deriving other income limits. The VLIL is calculated by taking the 4-person income limit equal to 50% of the estimated median family income (based on the U.S. Census Bureau’s ACS median family income estimates) and making adjustments if this income is outside formula constraints. For example, the VLIL is increased for areas where rental housing costs are unusually high in relation to the median income or if it is less that the relevant State non-metropolitan median family income level. See https://www.huduser.gov/portal/datasets/il.html#faq_2025

These income limits are not used for projects funded with tax credits under section 42 of the Internal Revenue Code and projects financed with tax exempt housing bonds issued to provide qualified residential rental development under section 142 of the Internal Revenue Code, i.e., LITHC, RHRF, etc. Go to HHFDC’s website at https://dbedt.hawaii.gov/hhfdc/files/2025/04/2025-MTSP-Income-Limits-2025-04-01.pdf for tax credit rental program projects.

NOTE: This chart is provided as a guide only.