Hawai‘i Community Lending has assisted more than 1,000 homeowners in wake of pandemic.

The counties of Kauaʻi and Hawaiʻi, and Hawaiʻi Community Lending (HCL) announced today their Homeowner Assistance Fund (HAF) programs will close their application portal on May 1, 2024.

The HAF programs were funded through the American Rescue Plan signed into law by the Biden Administration with the goal of preventing foreclosure in the wake of the COVID-19 pandemic. The announcement comes as HCL, the counties’ nonprofit administrator, projects funding for the programs will be fully obligated by Sept. 30, 2024. Homeowners who reside on Kauaʻi or Hawaiʻi and are interested in applying for the programs must submit complete applications no later than 11:59 p.m. on April 30, 2024, to be considered for funding.

“We mahalo the counties for their partnership in keeping our families in homes and the resiliency of our families who have been faced with hardship due to COVID,” said HCL Executive Director Jeff Gilbreath. “This public-private partnership is a demonstration of what is possible when nonprofits and counties work together to deliver federally funded programs that serve our families who are most in need.”

According to Gilbreath, HCL has successfully assisted 1,043 homeowners in preventing foreclosure since the HAF programs launched in October 2021. More than $8.1 million has been disbursed to help local homeowners reduce their monthly mortgage payments; bring their loans, property taxes, HOA fees, homeowners insurance and utility bills current; and for forward going payments.

With a month remaining before the programs close, homeowners in need can still get help. Homeowners applying for the Kauaʻi and Hawaiʻi County HAF programs must meet the following requirements to be eligible for financial assistance:

• Live in your home on Hawai‘i Island or Kaua‘i.

• Own no other real property.

• Have experienced financial hardship (i.e. a 10% decrease in annual income or 10% increase in household expenses since March 2020).

• Have less than five times your monthly housing expenses in assets (does not include pension/401k).

• Have a mortgage with one of the qualifying mortgage servicers (listed online); reverse mortgages allowed (not required for past-due property taxes and past-due HOA fees).

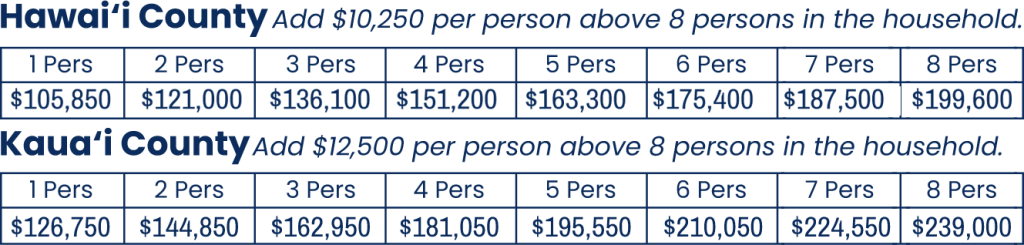

• Meet the maximum annual household income requirements:

For more information about the HAF programs or to apply, visit www.HawaiiCommunityLending.com/HAF.